Genmab, an organization whose antibodies are a part of medicine commercialized and in improvement within the fingers of companions throughout the biopharmaceutical trade, is increase its personal pipeline with the $1.8 billion acquisition of ProfoundBio. The deal introduced Wednesday brings Genmab three clinical-stage antibody drug conjugates, or ADCs, probably the most superior of which may compete in opposition to an AbbVie drug projected to change into a blockbuster vendor.

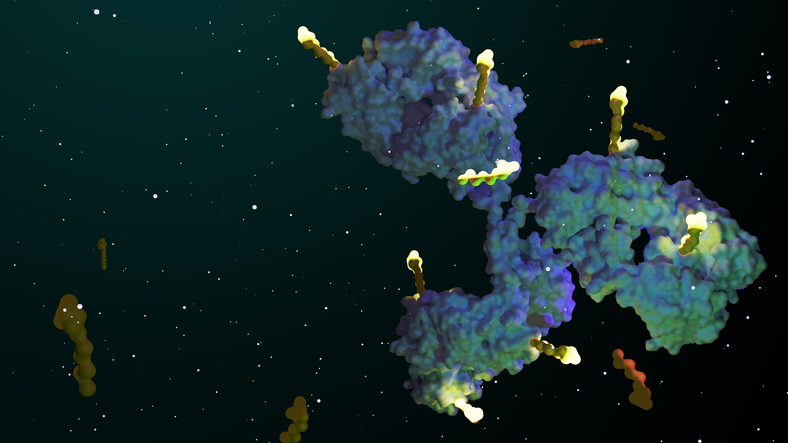

Privately held ProfoundBio is one in all a rising variety of corporations growing ADCs, which chemically hyperlink a poisonous drug payload to an antibody to supply focused supply of the remedy to tumors. The Seattle-based firm develops its ADCs with a linker know-how that permits the next drug to antibody ratio, growing the remedy’s efficiency whereas sustaining different properties, similar to its security profile.

Lead ProfoundBio program rinatabart sesutecan, or Rina-S, targets folate receptor alpha. This ADC is at present being evaluated within the Section 2 portion of a pivotal Section 1/2 examine in ovarian most cancers. Folate receptor alpha can be the goal of Elahere, a drug developed by ImmunoGen that in 2022 grew to become the primary ADC authorized for ovarian most cancers. Elahere was the centerpiece of AbbVie’s $10.1 billion acquisition of ImmunoGen final yr. The drug’s label carries a black field warning concerning the danger visible impairment, corneal injury, and different eye issues. Rina-S has not proven any corneal toxicity, in line with preliminary outcomes from the dose-escalation portion of the examine that had been introduced final fall through the annual assembly of the Society of Immunotherapy for Most cancers (SITC).

In a word despatched to traders, Leerink Companions analyst Jonathan Chang wrote that ProfoundBio’s Rina-S could possibly be best-in-class amongst folate receptor alpha-targeting ADCs, providing the potential to develop the addressable affected person inhabitants whereas additionally providing higher security than Elahere. Referencing the SITC information, Chang highlighted a 38% general response price throughout all doses in ovarian and endometrial most cancers sufferers in addition to a 67% general response price amongst sufferers with folate receptor alpha expression larger than 1%. As a result of Elahere’s FDA approval covers the therapy of sufferers who specific excessive ranges of the goal protein, Rina-S could provide a therapy possibility for sufferers with low folate receptor alpha ranges.

“The chance is that the acquisition relies on comparatively restricted medical information up to now though administration indicated that that they had entry to non-publicly obtainable information,” Chang stated. “We view this transaction as including a formidable competitor to this area given [Genmab’s] observe file of well timed and aggressive medical improvement.”

Copenhagen-based Genmab already has a presence in ADCs by companions. Tivdak, a drug developed with an antibody from Genmab and ADC know-how from Seagen (now a part of Pfizer), gained FDA approval in 2021 for treating superior cervical most cancers. The 2 corporations share within the commercialization of this drug, which is Genmab’s first authorized product. Genmab additionally data income from Epkinly, a bispecific antibody authorized final yr for cervical most cancers and commercialized below a partnership with AbbVie.

Genmab will get nearly all of its income from royalties paid by corporations which have commercialized medicine using its antibodies. A single drug, the Johnson & Johnson a number of myeloma medicine Darzalex, accounted for 68% of 2023 income, in line with the corporate’s annual report. Whereas that royalty income continues to develop, Genmab’s technique consists of growing medicine by itself and with companions. The Genmab pipeline spans 9 packages in varied phases of improvement for each strong tumors and blood cancers.

ProfoundBio, led by veterans of the ADC specialist Seagen, raised its preliminary funding in 2021. Its most up-to-date financing was a $112 million Sequence B financing in February. ADCs proceed to be a sizzling drug class for dealmaking. Gilead Sciences gained the ADC Trodelvy by way of an acquisition. AstraZeneca’s collaboration with Daiichi Sankyo led to a number of approvals for the ADC Enhertu. The Japanese drugmaker additionally has an alliance with Merck. Ipsen joined the ADC combine this week, licensing a Sutro Biopharma drug candidate. Startups that not too long ago raised cash for ADC R&D embrace Tubulis and Firefly Bio.

Genmab’s acquisition of ProfoundBio is a money deal. The boards of each corporations have authorized the transaction, which is anticipated to shut by the tip of June.

“We consider that ProfoundBio’s ADC candidates, proprietary know-how platforms and proficient workforce shall be a fantastic addition to Genmab and that, collectively, we will speed up the event of modern, differentiated antibody therapies for most cancers sufferers,” Genmab President and CEO Jan van de Winkel stated in a ready assertion.

Picture: Getty Photographs