In accordance with a current paper by Doshi et al. (2023), the reply is ‘sure‘! Why do individuals assume in any other case?

Many individuals are involved that there will not be a sustainable method for the non-public group insurance coverage market, notably in small self-insured corporations, to cowl gene therapies? If a agency—notably a smaller, self-insured agency—will get one or two sufferers who wants gene therapies, this might spoil their profitability for causes that don’t have anything to do with the underlying expense.

Nevertheless, gene remedy is the proper case for why insurance coverage is required:

In any case, the first aim of insurance coverage, in principle, is changing a big, sudden, unaffordable, however uncommon expense right into a reasonable insurance coverage premium, by spreading a person giant expense over many premium payers.”

Furthermore, in a aggressive market, corporations resolution to cowl cost-effective gene therapies could also be a aggressive benefit to draw labor.

…employers competing for risk-averse employees will supply such safety towards monetary threat if they’re to match what different employers (giant or small) supply.

Nevertheless, the

concern nonetheless could also be related for small corporations who self-insure and don’t maintain any

cease loss provisions for sufferers with outlier value. Companies self-insure for 3 main causes

(i) state taxes don’t apply to self-insured plans, (ii) corporations have extra

management over self-insured plans, and (iii) prices could also be decrease if the agency has a

more healthy than common inhabitants. What are cease loss provisions?

Cease-loss insurance coverage is a type of insurance coverage the place an outdoor insurer agrees to cowl self-insured employer claims in extra of some prespecified limits. It offers financing for unusually giant claims or declare totals.”

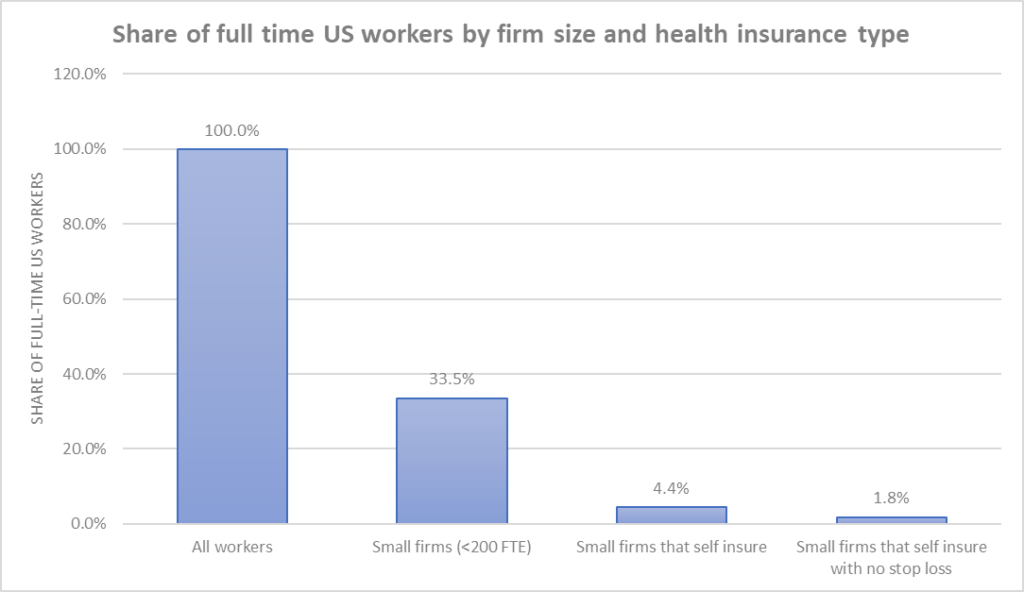

What number of employees are included in these kinds of corporations? Doshi et al. use knowledge from the Medical Expenditures Panel Survey Insurance coverage Element (MEPS-IC) and the Kaiser Household Basis (KFF) Well being Advantages Survey of Employer Well being Profit Choices to search out out. General, solely 1.8% of employees are employed at small, self-insured corporations with no stop-loss provision.

Furthermore, they

discover that knowledge from MEPS finds that even amongst small, self-insured corporations with

<200 FTE, 59.2% (MEPS) or 72% (KFF) have a stop-loss provision.

It’s true,

nonetheless, that the price of stop-loss protection has been rising over time. Between

2012-2022, cease loss insurance coverage protection elevated by 138% in comparison with household

premium will increase of solely 43% over that very same time interval.