Oncology is one among Ipsen’s three core therapeutic areas, and the corporate has been actively putting offers that add most cancers medicine to its portfolio and pipeline. The newest deal brings its first antibody drug conjugate. Whereas the ADC area has turn out to be crowded and aggressive, the ADC coming to Ipsen is engineered with expertise that the drugmaker believes might set it aside.

The ADC is from Sutro Biopharma. In line with deal phrases introduced Tuesday, Ipsen is committing to $92 million in near-term funds, together with an fairness funding in publicly traded Sutro.

Scientific-stage Sutro is an ADC specialist, growing medicine with options and properties that give them benefits over presently accessible ADCs in addition to some ADCs nonetheless in growth. Ipsen is getting world rights to STRO-003, a Sutro ADC engineered to focus on ROR1, a tumor antigen that’s overexpressed in lots of several types of most cancers, each stable tumors and blood cancers. Whereas ROR1 is a validated goal, there aren’t any FDA-approved medicine that hit it.

An ADC is comprised of a tumor-targeting antibody that’s chemically linked to a poisonous drug payload. Sutro engineered STRO-003 with its platform expertise that permits the conjugation of the linker and drug payload at particular websites on the antibody. Along with enhancing an ADC’s therapeutic profit, Sutro says its expertise leads to a extra steady ADC, which ought to assist make sure that the drug payload just isn’t launched prematurely.

Sutro has mentioned in regulatory filings that it believes STRO-003 has the potential to be the primary and best-in-class amongst ADC medicine focusing on ROR1. The corporate was getting ready to advance this ADC into the clinic for the remedy of stable tumors, together with triple adverse breast most cancers, non-small cell lung most cancers, and ovarian most cancers.

With STRO-003 heading to Ipsen, the Paris-based drugmaker joins a small group of firms additionally pursuing ROR1 with ADCs. Merck’s contender comes from its $2.75 billion acquisition of VelosBio in 2020. That drug candidate, zilovertamab vedotin, has reached Section 2 testing in blood cancers. Final 12 months, CStone Prescribed drugs started a Section 1 check of its ROR1-targeting ADC, code-named CS5001. Boehringer Ingelheim added a ROR1-targeting ADC to its pipeline by way of the 2020 acquisition of NBE Therapeutics. However that research was terminated final September. In the meantime, Lyell Immunopharma’s lead program goes after ROR1, however with a CAR T-therapy.

Most cancers is the largest driver of Ipsen’s gross sales, accounting for greater than €2.3 billion of the corporate’s €3.1 billion in income in 2023. A few of that development comes from newly acquired property. In 2017, Ipsen paid $575 million up entrance to accumulate Onivyde, a Merrimack Prescribed drugs drug accredited for treating superior pancreatic most cancers. In February, Onivyde received FDA approval as a first-line pancreatic most cancers remedy, which expands the marketplace for this remedy. Ipsen’s $247 million acquisition of Epizyme in 2022 introduced an FDA-approved remedy for follicular lymphoma. Ipsen has additionally pursued R&D offers, corresponding to its R&D alliance with T cell receptor remedy startup Marengo Therapeutics. On Tuesday, the companions introduced the nomination of the primary of two drug candidates coated by the multi-year pact.

Beneath the phrases of Ipsen’s settlement with Sutro, the French drugmaker will assume accountability for Section 1 preparation, together with the submission of an investigational new drug software to the FDA. Ipsen will even deal with all scientific growth and commercialization. The monetary construction of the deal doesn’t have a simple upfront cost. In line with a Sutro regulatory submitting, the license payment that Ipsen is paying is $50 million. Ipsen can be buying about $25 million price of Sutro shares. Attaining a specified developmental milestone would set off a cost of as much as $7 million. If that occurs, Ipsen should buy as much as $10 million price of further Sutro shares.

Further growth and regulatory milestone funds might add as much as $447 million, however that assumes progress in a number of indications, in keeping with the Sutro submitting. If the R&D results in commercialized merchandise, the deal contains one other $360 million in funds tied to gross sales milestones in addition to royalties from drug gross sales.

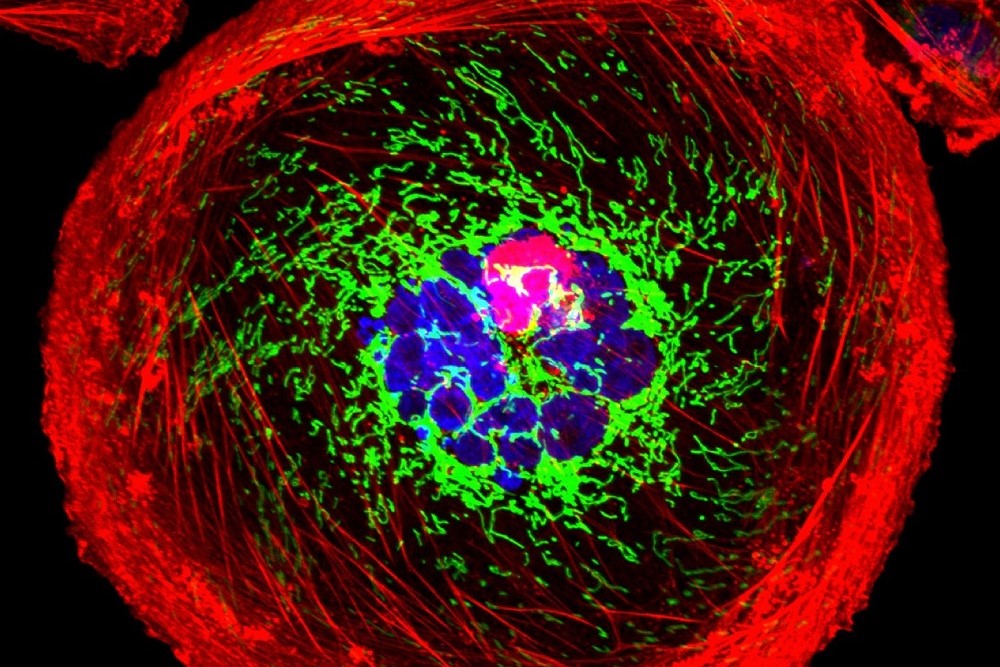

Public area picture by the Nationwide Most cancers Institute